With renowned economist Nouriel Roubini of NYU predicting the worst economic contraction in more than 40 years, author Bill Bonner predicting the Dow Jones will fall to 5,000, and some very interesting analysis about the role of credit default swaps in creating some of the worst excesses of the real estate market, it's easy to understand why investors would want to avoid assets in the United States. What's particularly important about the aforementioned analysis, is that it reports that there is a provision in the recently approved $700 billion bailout that allows the Federal Reserve to pay interest on collateral held in exchange for loans. Under this scenario, the financial institutions can give take a loan out at the Fed, offering equity or some of the worst financial derivatives that mathematicians can imagine supported by some of the worst lending since the 1920's as collateral. Then, with the Treasuries or cash that the institution has borrowed, earn profit, and also earn more in interest than the derivative might be worth, thanks to the end of mark-to-market accounting. Which, in summation, amounts to one of the subtlest giveaways in an era of high-priced socialization.

However, one doesn't need to be an investor to feel worried about the economy. Simply talk to state and local employees and the citizens who rely on their services, in places such as Chicago; King County, WA; Iowa; Maryland; and Massachusetts. In other news, the federal government announced a $455 billion budget deficit for Fiscal Year '08, which doesn't count Treasurer Hank Paulson's commitments to the financial industry, which will push the deficit in '09 even higher, in addition to whatever additional economic stimulus is passed in the coming months.

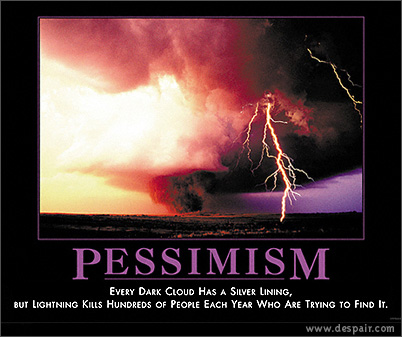

There's even more pessimism in whether the announced $250 billion equity binge on nine of the largest financial institutions in America will have any effect on their behavior whatsoever. Despite the investments, up to $25 billion in some cases, the Treasury didn't receive the right to make policy decisions, such as board appointments. So other than hold more meetings and perhaps more begging on one knee, the Treasury's hands are tied.

No comments:

Post a Comment